The Hard Asset Flywheel:

Build Compounding Wealth Across Real Estate, Gold, and Bitcoin

A timeless strategy for growing and preserving wealth through the strongest assets on Earth.

Own Real Assets. Grow Real Wealth. Repeat.

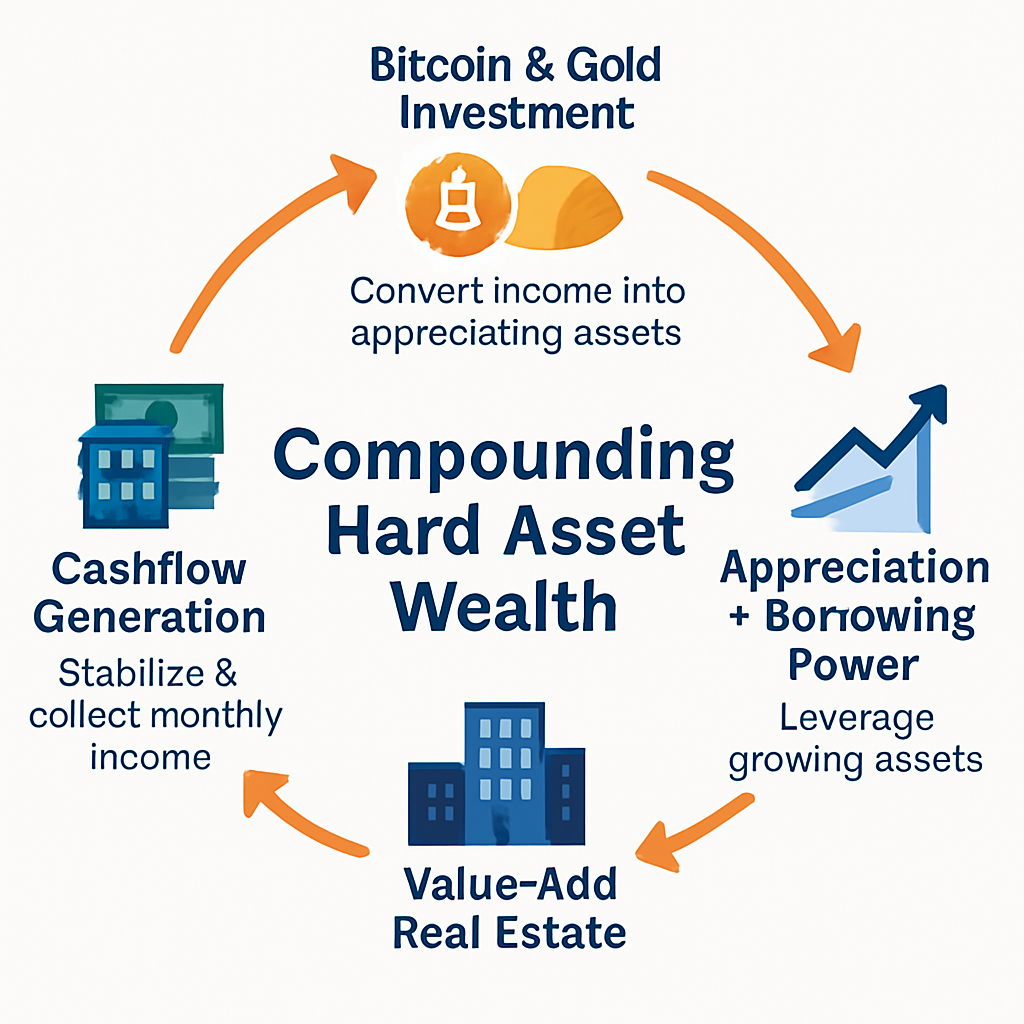

The Hard Asset Flywheel is Capital Advisors’ proprietary wealth-building strategy designed for today’s unpredictable world. We acquire value-add multifamily real estate that generates strong cashflow. That cashflow is then systematically allocated into gold and Bitcoin every month — assets historically proven to preserve and accelerate wealth. As these assets appreciate, we strategically leverage their value to acquire even more real estate, expanding your ownership across a diversified, compounding portfolio of hard assets.

The Hardest Assets on Earth

Why the Flywheel Outperforms Traditional Investments

One investment, multiple streams of wealth creation.

Real estate provides stable, cashflowing income and tax benefits

Gold preserves purchasing power over decades

Bitcoin offers 21st-century growth acceleration

No reliance on depreciating fiat currencies

Ownership compounds across multiple assets without injecting new capital

Built-in hedge against inflation, currency risk, and market volatility

How It Works for Our Investors

Steps:

Invest into the Capital Advisors Hard Asset Flywheel Fund.

Own a proportional share in real estate, gold, and Bitcoin holdings.

Earn monthly cashflow distributions from stabilized properties.

Grow your portfolio value through real estate appreciation and Bitcoin/gold accumulation.

Compound: We leverage the growth to acquire more properties, expanding your ownership over time — without requiring new investments.

Why These Hard Assets?

What makes them a hard asset?

We invest in multifamily real estate, gold, and Bitcoin because they are time-tested, resilient assets that preserve, grow, and protect wealth across any economic environment.

Multifamily Real Estate

Multifamily real estate is one of the most proven and resilient asset classes for building and preserving wealth. By owning income-producing properties, investors benefit from consistent cashflow, appreciation, and powerful tax advantages. Multifamily assets perform especially well in uncertain markets, as housing remains a fundamental need regardless of economic conditions.

Generates steady, passive income through rents

Historically appreciates over time while hedging against inflation

Offers significant tax benefits through depreciation and cost segregation

Provides strong resilience during economic downturns

Gold

Gold is the original hard asset — a timeless store of value trusted across civilizations and centuries. It has preserved purchasing power through wars, depressions, and currency devaluations. As a scarce, globally recognized asset, gold acts as an anchor of stability in any well-diversified portfolio.

Protects wealth against inflation and currency risk

Maintains intrinsic value across economic cycles

Offers liquidity and universal recognition

Acts as a safe haven during financial crises

Bitcoin

Bitcoin is the evolution of hard assets for the digital age — decentralized, finite, and immune to traditional monetary policy manipulation. With only 21 million coins ever created, Bitcoin provides an asymmetric upside opportunity while offering protection against inflation and currency devaluation in the modern economy.

Fixed supply capped at 21 million coins

Immune to inflationary monetary policy and government control

Highly portable, borderless, and secure

Offers exponential growth potential alongside traditional hard assets

Join a community of investors building generational wealth through strategic real estate, gold, and Bitcoin ownership.

Ready to Grow and Protect Your Wealth with Real Assets?